Outcomes-Based Financing Data Advisory Council

Creating a national outcomes-based financing Data Advisory Council (DAC) to capture and share best practices for using data to measure the social impact of outcomes-based financing.

The investment community’s understanding of the impact made by outcome-based financing is hampered by a lack of data. As of now, there are no centralized, holistic databases of impact investing data (e.g. benchmarks, sample portfolios, returns and/or performance ranges, market deal terms) that the broader finance community typically uses. As such, investors do not have the same tools to evaluate their investments’ impact that they do to evaluate financial performance. The wider community, similarly, has no data-informed method to assess if the financial community equitably allocates their investments and access to financing.

Third Sector, BrightHive, and Reinvestment Fund are partnering to launch a national outcomes-based financing Data Advisory Council (DAC). Comprised of stakeholders interested in using data to measure and evaluate the social impact of outcomes-based financing efforts, the DAC will address barriers to scalable and equitable improvements in lives and communities. The Council will share with its stakeholders new frameworks and shared insights on interventions, quantifying impact, measuring equitable outcomes, and improving fair lending practices. Ultimately, the DAC’s goal is to advance common knowledge across the community investment sector including impact investors (such as community development financial institutions [CDFI]), employers, and learning institutions.

We envision that the DAC will:

- Provide recommendations for adopting scalable and equitable risk-sharing models for employers, training providers, and learners.

- Establish a minimum set of practices for fair and equitable lending of outcome-based financing (OBF) tools. That is, provide guidance on what data-informed methods verify that lending practices are fair and equitable.

- Provide recommendations for evaluating the social impact of outcomes-focused investments such as Career Impact Bonds and Opportunity Zone efforts.

Outcomes-based financing (OBF) encourages spending on interventions that produce results, improve service delivery, and enable governments or philanthropists to pay directly for impact by tying payments to real, measured outcomes. Examples include Pay for Success efforts, talent financing tools such as career impact bonds and income-sharing agreements, Opportunity Zones (OZ) investments, community investing, and other data-driven financing mechanisms. Taking a three-phased approach over the course of approximately twelve months, the Data Advisory Council will drive adoption of data-driven approaches for measuring social impact, fair lending practices, and equitable outcomes. The initial focus of the DAC is workforce development and transforming “learners” to “employees.”

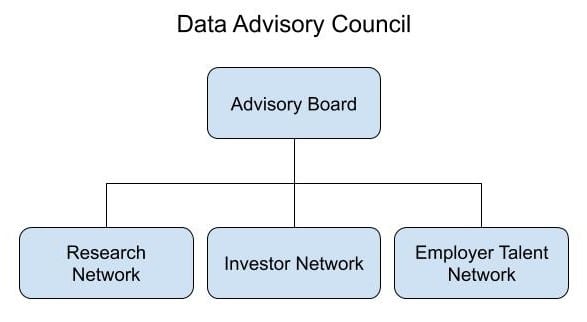

The DAC will have an Advisory Board and several participatory networks, each network being focused on different aspects of the solution. The networks will incorporate multiple viewpoints and provide the Board with the necessary expertise in relevant aspects of the Council’s work. The three networks are focused respectively on Research, Investments, and Employers.

The Board will guide and oversee the member networks’ exploration of opportunities to measure outcomes and fair lending practices. Initial organizations that expressed interest in serving on the Advisory Board include the U.S. Chamber of Commerce Foundation, Social Finance, Whiteboard Advisors, George Washington Institute of Public Policy, Federal Reserve Bank of Atlanta, The Beeck Center at Georgetown University, and Social Value International.

Third Sector’s initial role is facilitating the Research Network, which is tasked with defining common Return of Investment (ROI) measures. The Research Network includes organizations like MDRC, Mathematica, J-PAL, the Brookings Institution, and the Urban Institute, which all use large data sets to develop evidence and policy recommendations in workforce development. The network, through Third Sector, will document findings and insights across a wide range of researchers like common sets of metrics on the effectiveness of programs and their impact.

Third Sector’s report will include a baseline set of indicators for measuring equity and return on investment and record insights from key players and efforts in OBF, impact management, and impact investing communities. Part of this is finding, assessing, and analyzing best practices, frameworks, standards, and lessons learned from across the workforce development community. This landscape report will enable the continued growth and goal sharing of the DAC and introduce a baseline set of indicators to community groups. These indicators will become a common language between the investor and employer networks on how to perceive impact and understand other stakeholders’ needs.

The DAC has already started to bring together thoughtful and well-researched resources that can serve as a guidepost for future investments aimed at increasing equity and opportunity. In the long-term, a common, data-informed framework to evaluate impact investment decisions and a single impact baseline for impact investors to expand their impact over time will increase the efficacy and influence of workforce development investments.

THE TEAM

The Data Advisory Council will be led by Third Sector, BrightHive, and Reinvestment Fund. Reinvestment Fund will be an advisor for the Board. Third Sector will serve as a Co-Lead of the DAC, ensuring the Advisory Board convenes and completes any follow-on tasks, as well as supporting both the development and publishing of key deliverables on behalf of the DAC. BrightHive will serve as a Lead Technical Advisor for the DAC, conducting any necessary research and analysis.

Third Sector. We support clients in adopting an outcomes orientation at every level – from an individual program to an entire jurisdiction. Third Sector offers our partner communities the ability to understand and improve the incentives within systems and services. Third Sector has launched 13 outcomes-oriented contracts that transitioned over $800 million in public funding towards outcomes.

BrightHive. We deliver Data Trust Development Services through stakeholder convening and use-case development. By using the Data Trust, partners can discover the information latent in their data and improve systems design to improve their business operations and impact.

Reinvestment Fund. We transform the health and well-being throughout the country through long-term commitments to the cities and towns we work with. Our work has given better access to critical services and amenities that help families start strong and stay healthy to more than 2 million people nationwide. As a federally certified CDFI, we manage $1.2 billion that comes from 880 investors.